early distributions are indicated in which box of form 1099-r Qualified distributions to reservists while serving on active duty for at least 180 days. Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include . CNC inserts, also known as cutting inserts or tool inserts, are replaceable cutting tips meticulously crafted for CNC machining operations. These inserts come in a variety of shapes, sizes, and materials, each tailored .

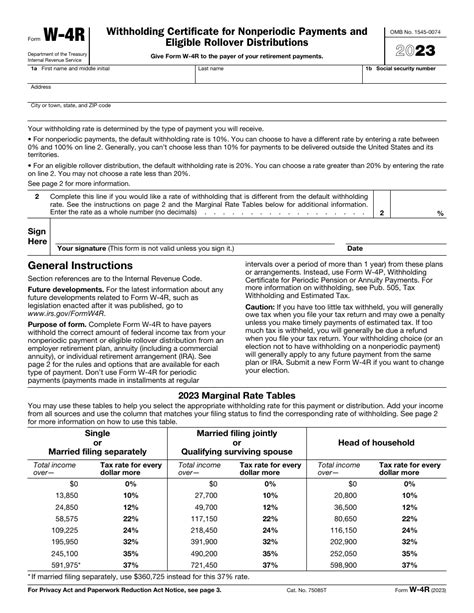

0 · irs non periodic distribution form

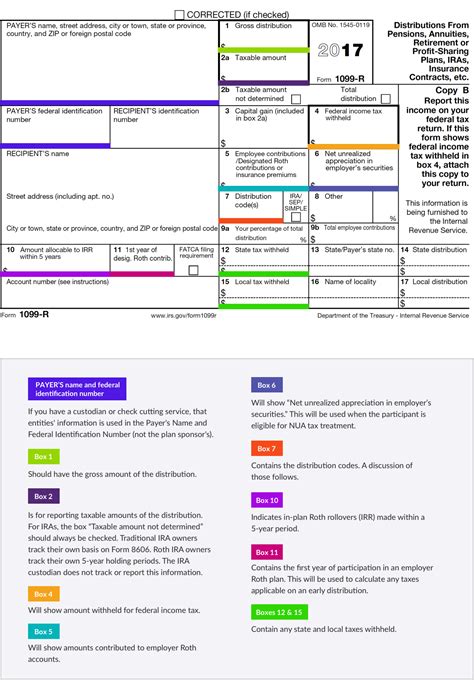

1 · form 1099 r distribution code

2 · early distribution exemptions

3 · early distribution exclusion form

4 · are early distributions tax exempt

5 · 1099 r form pdf

6 · 1099 r exemption form

7 · 1099 r distribution code 2

Box and whisker plots are a type of graph used to visualize the distribution of data. They offer a quick and informative way to understand several key aspects of your data set. So, let's see what box and whisker plots show: Spread of the .

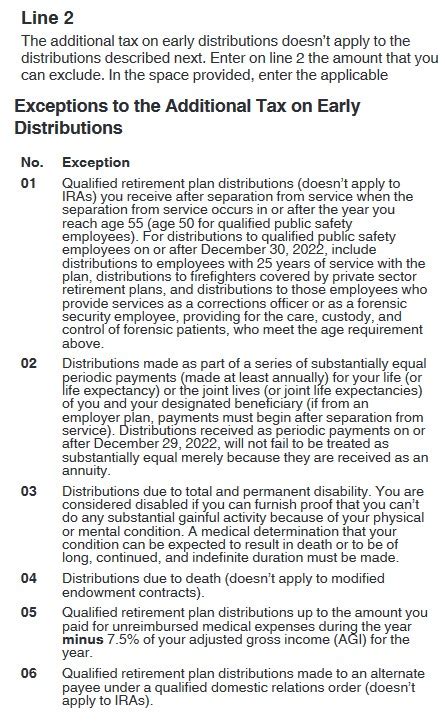

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403 (b) plan and is not subject to the 10% additional tax on early distributions.Information about Form 1099-R, Distributions From Pensions, Annuities, .Generally, if you are under age 59 1/2, you must pay a 10% additional tax on the distribution of any assets (money or other property) from your traditional IRA. Distributions before you are .Qualified distributions to reservists while serving on active duty for at least 180 days. Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include .

Do you have to pay taxes on income reported on Form 1099-R? Whether the distributions reported on Form 1099-R are taxable depends on the type of account they came .

Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a . This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older. Distributions .

To enter an early distribution exception from Form 1099R: Under Input Return, select Income. Select Pensions, IRAs (1099R). Select the Details button. Select the Form 5329 tab. Under .For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403 (b) plan and is not subject to the 10% additional tax on early distributions.On Form 1099-R, the distribution code in Box 7 identifies the type of distribution, with distribution codes 1 and 2 indicating an early distribution. In addition to code 1 or 2, Box 7 might also contain a secondary code:Generally, if you are under age 59 1/2, you must pay a 10% additional tax on the distribution of any assets (money or other property) from your traditional IRA. Distributions before you are age 59 1/2 are called "Early Distributions."

Qualified distributions to reservists while serving on active duty for at least 180 days. Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older. Do you have to pay taxes on income reported on Form 1099-R? Whether the distributions reported on Form 1099-R are taxable depends on the type of account they came from and the nature of the distribution (for example, whether it was a standard or early distribution). Here's how the tax rules break down for distributions taken from retirement . Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498 . This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B (Designated Roth) Code U: Dividends distributed from an ESOP under section 404(k).

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

irs non periodic distribution form

form 1099 r distribution code

Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older. Distributions from a section 457 plan, which aren’t from a rollover from a qualified retirement plan.

To enter an early distribution exception from Form 1099R: Under Input Return, select Income. Select Pensions, IRAs (1099R). Select the Details button. Select the Form 5329 tab. Under 5329 (Part 1), enter the amount that isn't subject to 10%/25% tax in the Amount excluded from 10%/25% tax field.

For distributions made after December 31, 2023, a distribution to a domestic abuse victim may be made from a 403 (b) plan and is not subject to the 10% additional tax on early distributions.

On Form 1099-R, the distribution code in Box 7 identifies the type of distribution, with distribution codes 1 and 2 indicating an early distribution. In addition to code 1 or 2, Box 7 might also contain a secondary code:

Generally, if you are under age 59 1/2, you must pay a 10% additional tax on the distribution of any assets (money or other property) from your traditional IRA. Distributions before you are age 59 1/2 are called "Early Distributions."Qualified distributions to reservists while serving on active duty for at least 180 days. Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older. Do you have to pay taxes on income reported on Form 1099-R? Whether the distributions reported on Form 1099-R are taxable depends on the type of account they came from and the nature of the distribution (for example, whether it was a standard or early distribution). Here's how the tax rules break down for distributions taken from retirement . Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498 .

This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B (Designated Roth) Code U: Dividends distributed from an ESOP under section 404(k).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

Distributions incorrectly indicated as early distributions by code 1, J, or S in box 7 of Form 1099-R. Include on line 2 the amount you received when you were age 591/2 or older. Distributions from a section 457 plan, which aren’t from a rollover from a qualified retirement plan.

early distribution exemptions

early distribution exclusion form

Metal siding panels range anywhere from $2.50- $5.00 per sq ft. The price of the panel not only depends on the panel profile you choose, but also the gauge and paint system. Metal panels come in either an exposed fastener .

early distributions are indicated in which box of form 1099-r|are early distributions tax exempt